24+

Case studies & discussions

25+

Speakers & panelists

12+

Partners & sponsors

120+

Regional attendess

ATTENDEE PROFILE

45%

Insurance & Reinsurance Companies

25%

Agents & Brokers

10%

IT Providers & InsurTech

10%

Risk Experts & Consultants

5%

Regulators & Industry Associations

5%

Other Insurance Professionals

Networking

Connect with industry leaders, carriers, regulators, and market players. Benefit from personalized one-to-one meetings, interactive discussions, and a cocktail reception to expand your professional network in the CEE insurance market

Content

Stay ahead of the curve with thought-provoking content presented by expert speakers and panelists. Gain valuable insights on the latest trends, challenges, and opportunities in the insurance industry, empowering you to grow your business and achieve your goals.

Regional Exposure

Meet industry leaders from across the CEE region and gain insights into different markets. This is a valuable opportunity for companies looking to expand their presence, forge key relationships with insurance companies in CEE, and stay ahead of the competition.

Lead Generation

Generate leads and grow your business by meeting new contacts, building meaningful relationships, and expanding your professional network within the insurance industry. Whether you seek new clients, an expanded customer base, or strategic partnerships, Insurance CEE Expo is the place to be.

What is Insurance CEE Expo?

About #INSCEE24

Following the success of INSCEE23 in Prague, we're excited to bring the 2nd edition to Bucharest, Romania, continuing our tradition. Just like before, we'll bring together leading insurance experts for two days filled with engaging sessions, discussions, and networking opportunities in the vibrant heart of Romania.

Sounds familiar?

You’re not alone.

You’re tired of conferences full of buzzwords — but no real answers come Monday.

“Every year we hear about trends, but nothing we can actually implement in our company.”

Your initiative is stuck — again — between vision and execution

“The board said ‘let’s discuss it later’, IT said ‘no resources’, and you’re left alone again.”

You’re responsible for digital — not just for presentations, but for real results that move yourcareer forward.

“I want to show progress, not just plans — it’s key for my next step.”

You want real conversations — with people who’ve already done it, not just those who knowthe theory.

“I need honest, peer-level exchange — with data, lessons, and no posturing.”

What You’ll Get at INSCEE26

Day 1 — Tech, AI & Real-World Transformation

-

See how GenAI is already used in underwriting and claims

-

Learn when to modernize vs. rebuild your tech stack

-

Discover what’s next in digital sales and bancassurance

-

Explore embedded, parametric, and InsurTech cases from CE

Day 2 — Resilience, CX & Business Growth

-

Understand how insurers handle climate and catastrophe risks

-

Reimagine customer experience with AI-powered personalization

-

Balance automation and human support in real CX flow

Also on the Agenda

-

Motor, telematics, life & health innovation

-

Digital culture and future skills

-

Personalization that actually converts

🍸 Curated 1-on-1 meetings & evening reception

You’ll leave with:

✔ A clear plan for cloud, GenAI & CX transformation

✔ Proven solutions from CEE, not theory

✔ Trusted peer contacts for pilots and partnerships

PAST SPEAKERS

2024 SPEAKERS

IN PARTNERSHIP WITH

Advisory Board

30% off

Enter coupon code INSCEE24EARLYB to get 30% off any ticket type!

Valid until 19.4.2024

For refund & cancellation policy please refer to Terms & Conditions

For any questions related to pricing and tickets please reach out info@inscee.eu

IT & Service Provider

For attendees employed by a technology or a service company that is not involved in insurance brokerage but instead offering IT or other solutions for insurance sector.

Agent & Broker

For attendees employed by a broker or agent company that is involved in soliciting or seeking coverage from various insurance companies

TICKETS

Please choose your ticket category according to your employer type. We reserve the right to request attendee's employment confirmation to verify the purchased ticket category. Each ticket includes 1) full 2-day access to the event, 2) access to the exhibition area, 3) access to cocktail reception, 4) all conference materials.

TICKETS

SPONSORS

AGENDA

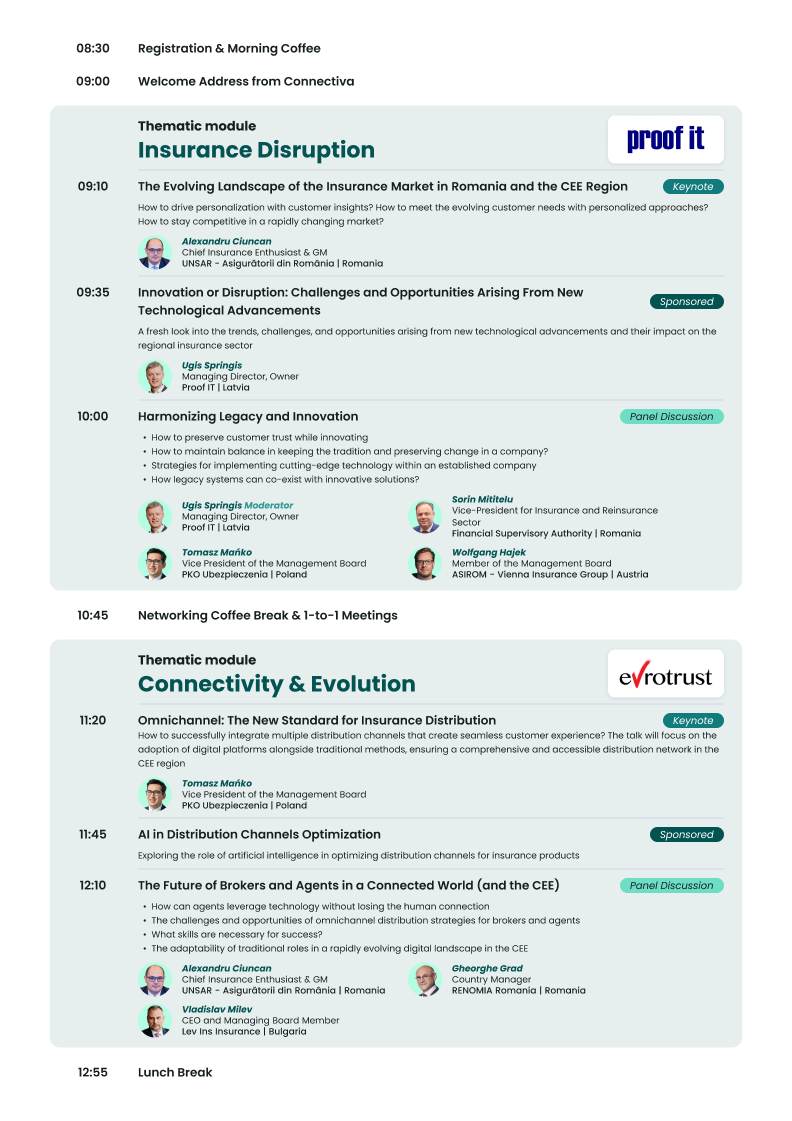

08:30

Registration & Morning Coffee

09:00

Welcome Address from Connectiva

10:45

Networking Coffee Break & 1-to-1 Meetings

12:55

Lunch Break

15:40

Networking Coffee Break & 1-to-1 Meetings

17:50

End of Day 1

18:30

Cocktail Reception

09:35

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

A fresh look into the trends, challenges, and opportunities arising from new technological advancements and their impact on the regional insurance sector

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

Sponsored

Panel discussion

Harmonizing Legacy and Innovation

-

How to preserve customer trust while innovating

How to maintain balance in keeping the tradition and preserving change in a company?

Strategies for implementing cutting-edge technology within an established company

How legacy systems can co-exist with innovative solutions?

Ugis Springis Moderator

Managing Director, Owner

Proof IT | Latvia

Sorin Mititelu

Vice-President for Insurance and Reinsurance Sector

Financial Supervisory Authority | Romania

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Austria

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

Harmonizing Legacy and Innovation

Panel discussion

-

How to preserve customer trust while innovating

-

How to maintain balance in keeping the tradition and preserving change in a company?

-

Strategies for implementing cutting-edge technology within an established company

-

How legacy systems can co-exist with innovative solutions?

Ugis Springis Moderator

Managing Director, Owner

Proof IT | Latvia

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Austria

Sorin Mititelu

Vice-President for Insurance and Reinsurance Sector

Financial Supervisory Authority | Romania

Harmonizing Legacy and Innovation

Panel Discussion

10:00

-

How to preserve customer trust while innovating

-

How to maintain balance in keeping the tradition and preserving change in a company?

-

Strategies for implementing cutting-edge technology within an established company

-

How legacy systems can co-exist with innovative solutions?

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Austria

Sorin Mititelu

Vice-President for Insurance and Reinsurance Sector

Financial Supervisory Authority | Romania

Ugis Springis Moderator

Managing Director, Owner

Proof IT | Latvia

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

The Evolving Landscape of the Insurance Market in Romania and the CEE Region

Keynote

How the blend of traditional underwriting expertise and digital innovations is shaping the future of risk assessment and policy customization. Is the CEE region ready for digital underwriting approaches?

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

The Evolving Landscape of the Insurance Market in Romania and the CEE Region

Keynote

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

How to drive personalization with customer insights? How to meet the evolving customer needs with personalized approaches? How to stay competitive in a rapidly changing market?

How to drive personalization with customer insights? How to meet the evolving customer needs with personalized approaches? How to stay competitive in a rapidly changing market?

The Evolving Landscape of the Insurance Market in Romania and the CEE Region

Keynote

09:10

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

09:10

10:00

A fresh look into the trends, challenges, and opportunities arising from new technological advancements and their impact on the regional insurance sector

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

09:35

Ugis Springis

Managing Director, Owner

Proof IT

11:20

11:45

12:10

Panel discussion

Keynote

Omnichannel: The New Standard for Insurance Distribution

How to successfully integrate multiple distribution channels that create seamless customer experience? The talk will focus on the adoption of digital platforms alongside traditional methods, ensuring a comprehensive and accessible distribution network in the CEE region

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

Omnichannel: The New Standard for Insurance Distribution

Keynote

The Future of Brokers and Agents in a Connected World (and the CEE)

-

How can agents leverage technology without losing the human connection

-

The challenges and opportunities of omnichannel distribution strategies for brokers and agents

-

What skills are necessary for success?

-

The adaptability of traditional roles in a rapidly evolving digital landscape in the CEE

Vladislav Milev

CEO and Managing Board Member

Lev Ins Insurance | Bulgaria

Lyubomir Tankishev Moderator

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

Gheorghe Grad

RENOMIA Romania

Country Manager | Romania

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

Gheorghe Grad

RENOMIA Romania

Country Manager | Romania

Vladislav Milev

CEO and Managing Board Member

Lev Ins Insurance | Bulgaria

Lyubomir Tankishev Moderator

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

Panel Discussion

Sponsored

How to successfully integrate multiple distribution channels that create seamless customer experience? The talk will focus on the adoption of digital platforms alongside traditional methods, ensuring a comprehensive and accessible distribution network in the CEE region

Omnichannel: The New Standard for Insurance Distribution

Keynote

11:20

Tomasz Mańko

Vice President of the Management Board

PKO Ubezpieczenia | Poland

The Future of Brokers and Agents in a Connected World (and the CEE)

Panel Discussion

12:10

-

How can agents leverage technology without losing the human connection

-

The challenges and opportunities of omnichannel distribution strategies for brokers and agents

-

What skills are necessary for success?

-

The adaptability of traditional roles in a rapidly evolving digital landscape in the CEE

Lyubomir Tankishev Moderator

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

Vladislav Milev

CEO and Managing Board Member

Lev Ins Insurance | Bulgaria

Alexandru Ciuncan

President & General Manager

UNSAR – The Romanian Insurers’ Association | Romania

Gheorghe Grad

RENOMIA Romania

Country Manager | Romania

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Lyubomir Tankishev

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

Accelerate Growth in All Distribution Channels with Digitalization and Identity Services

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Accelerate Growth in All Distribution Channels with Digitalization and Identity Services

Lyubomir Tankishev

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

Accelerate Growth in All Distribution Channels with Digitalization and Identity Services

Sponsored

11:45

Lyubomir Tankishev

Director Business Development & Strategic Partnerships

Evrotrust | Bulgaria

14:05

14:30

14:55

Forging Strategic Digital Banking Partnerships in the CEE Region

Sponsored

Fostering a Culture of Innovation within CEE Banks

-

What role does culture play in digital adoption and transformation in banks?

-

The importance of cross-department collaboration

-

How does a culture of innovation contribute to the overall strategic goals of CEE banks?

-

What role does leadership play in fostering a culture of innovation?

Panel discussion

Agile Strategies for Digital Evolution in CEE Banking Sector

Agile Strategies for Digital Evolution in CEE Banking Sector

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Marcin Konkel

Mortgage Chief Product Owner

mBank | Poland

Juraj Tlsty

CIO

Erste Bank | Serbia

Sponsored

Claimflation: Addressing the Inflation Impact on Repair Costs in CEE Claims Landscape

Keynote

In this session, experts will tackle the phenomenon of 'claimflation'—the rising costs of repairs impacting insurance claims in the Central and Eastern European (CEE) region.

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Claimflation: Addressing the Inflation Impact on Repair Costs in CEE Claims Landscape

Keynote

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

In this session, experts will tackle the phenomenon of 'claimflation'—the rising costs of repairs impacting insurance claims in the Central and Eastern European (CEE) region.

In this session, experts will tackle the phenomenon of 'claimflation'—the rising costs of repairs impacting insurance claims in the Central and Eastern European (CEE) region.

Claimflation: Addressing the Inflation Impact on Repair Costs in CEE Claims Landscape

Keynote

14:05

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

Panel discussion

The Claims Process of Tomorrow

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Marcin Konkel

Mortgage Chief Product Owner

mBank | Poland

Snežana Ignjatić

Chief Information Officer

Erste Bank | Serbia

Sonja Vučić

Sonja VučićChief Data Officer

NLB Bank a.d. Banja Luka | Bosnia and Herzegovina

Barry Frame Moderator

Chief Sales Officer

Veripark | UK

Julian Masliankov Moderator

Executive Director

Sirma InsurTech | Bulgaria

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

Shinji Shirai

Senior Process Architect

VIG Re

-

Future landscape of claims processing and the evolving technologies shaping it in the CEE

-

The impact of AI and machine learning on the speed and accuracy of claims resolution

-

Addressing the ethical considerations and customer trust issues in an increasingly automated claims environment

Tamas Tallarom

Claims Director

KÖBE Insurance

The Claims Process of Tomorrow

Panel discussion

Shinji Shirai

Senior Process Architect

VIG Re

Tamas Tallarom

Claims Director

KÖBE Insurance

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

Julian Masliankov Moderator

Executive Director

Sirma InsurTech | Bulgaria

-

Future landscape of claims processing and the evolving technologies shaping it in the CEE

-

The impact of AI and machine learning on the speed and accuracy of claims resolution

-

Addressing the ethical considerations and customer trust issues in an increasingly automated claims environment

The Claims Process of Tomorrow

Panel Discussion

14:55

-

Future landscape of claims processing and the evolving technologies shaping it in the CEE

-

The impact of AI and machine learning on the speed and accuracy of claims resolution

-

Addressing the ethical considerations and customer trust issues in an increasingly automated claims environment

Julian Masliankov Moderator

Executive Director

Sirma InsurTech | Bulgaria

Tamas Tallarom

Claims Director

KÖBE Insurance

Shinji Shirai

Senior Process Architect

VIG Re

Viktorija Katilienė

Head of Claims Department Baltics

Gjensidige Lietuva | Lithuania

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

Charting the Course: Navigating New Frontiers in Claims Experience Optimization

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Ugis Springis

Managing Director, Owner

Proof IT | Latvia

Charting the Course: Navigating New Frontiers in Claims Experience Optimization

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

Innovation or Disruption: Challenges and Opportunities Arising From New Technological Advancements

Sponsored

Charting the Course: Navigating New Frontiers in Claims Experience Optimization

Sponsored

14:30

Vasil Vasilev

Head of Key Partnerships

Bulstrad Life | Bulgaria

16:40

17:05

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Decoding Risk: The Power of AI in Insurance Underwriting

Olena Horshkova

Senior Actuary and Underwriting Expert

K2G | Switzerland

Increased Adoption of Machine Learning and AI in the CEE Insurance Sector

Sponsored

Sponsored

The Art and Science of Digital Underwriting

Keynote

How the blend of traditional underwriting expertise and digital innovations is shaping the future of risk assessment and policy customization. Is the CEE region ready for digital underwriting approaches?

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

Panel discussion

Balancing Technology and Human Judgment in Underwriting Decisions

-

The evolving role of human intuition alongside AI

-

Strategies for integrating AI without compromising the value of human expertise

-

Ethical implications of AI-driven underwriting decisions

-

The future of underwriting skills and training

Arina Man Moderator

Chief Executive Officer

K2G | Switzerland

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Romania

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

Shinji Shirai

Senior Process Architect

VIG Re

Olivia Tutu Mares

Director of Corporate and Special Risks Underwriting Department

ASIROM - Vienna Insurance Group

Agile Strategies for Digital Evolution in CEE Banking Sector

Keynote

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

Juraj Tlsty

Chief Delivery Officer

Slovenská sporiteľňa | Slovakia

How the blend of traditional underwriting expertise and digital innovations is shaping the future of risk assessment and policy customization. Is the CEE region ready for digital underwriting approaches?

Agile Strategies for Digital Evolution in CEE Banking Sector

Panel discussion

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

Shinji Shirai

Senior Process Architect

VIG Re

Olivia Tutu Mares

Director of Corporate and Special Risks Underwriting Department

ASIROM - Vienna Insurance Group

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Romania

Arina Man Moderator

Chief Executive Officer

K2G | Switzerland

-

The evolving role of human intuition alongside AI

-

Strategies for integrating AI without compromising the value of human expertise

-

Ethical implications of AI-driven underwriting decisions

-

The future of underwriting skills and training

The Art and Science of Digital Underwriting

Keynote

16:15

How the blend of traditional underwriting expertise and digital innovations is shaping the future of risk assessment and policy customization. Is the CEE region ready for digital underwriting approaches?

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

Balancing Technology and Human Judgment in Underwriting Decisions

Panel Discussion

17:05

-

The evolving role of human intuition alongside AI

-

Strategies for integrating AI without compromising the value of human expertise

-

Ethical implications of AI-driven underwriting decisions

-

The future of underwriting skills and training

Arina Man Moderator

Chief Executive Officer

K2G | Switzerland

Wolfgang Hajek

Member of the Management Board

ASIROM - Vienna Insurance Group | Romania

Olivia Tutu Mares

Director of Corporate and Special Risks Underwriting Department

ASIROM - Vienna Insurance Group

Shinji Shirai

Senior Process Architect

VIG Re

Normen Klöpperpieper

Sr. P&C Solutions Sales Manager NCEE

Swiss Re - Reinsurance Solutions | Switzerland

16:15

Decoding Risk: The Power of AI in Insurance Underwriting

Sponsored

16:40

Olena Horshkova

Senior Actuary and Underwriting Expert

K2G | Switzerland

TICKETS

Recommended

TICKETS

Participation is FREE of charge for representatives of insurance/reinsurance companies, financial regulators/policymakers, and brokers. Consultants, solution providers, IT companies, aggregators, or other service providers - please submit the Partner form or contact sponsorship@connectiva.events

INCLUDES | BASIC | STANDART | FULL | PREMIUM |

|---|---|---|---|---|

2-day access to event including all sessions and zones | ✓ | ✓ | ✓ | ✓ |

Coffee & lunch breaks | ✓ | ✓ | ✓ | ✓ |

Event materials | ✓ | ✓ | ✓ | ✓ |

Notepad and pen | ✓ | ✓ | ✓ | ✓ |

Cocktail reception | ✓ | ✓ | ✓ | |

WhatsApp chat | ✓ | ✓ | ✓ | |

Recordings of the event | ✓ | ✓ | ||

All PDF presentations | ✓ | ✓ | ||

Exclusive access to the speaker dinner | ✓ |

Are you attending as a team? Take advantage of our group discounts of up to 15% for groups of 3 or more!

INCLUDES | BASIC |

|---|---|

2-day access to event including all sessions and zones | ✓ |

Coffee & lunch breaks | ✓ |

Event materials | ✓ |

Notepad and pen | ✓ |

Cocktail reception | |

WhatsApp chat | |

Recordings of the event | |

All PDF presentations | |

Exclusive access to the speaker dinner |

FAQ

We get it. Let us know your schedule — we’ll help you prioritize the most relevant sessions and pre-book key 1-on-1 meetings so you get full value even if attending part-time.

This isn’t another inspiration-driven show. INSCEE26 is built for execution: CEE-specific cases, practical tools, and honest conversations with people who’ve already implemented

Perfect. We’ll match you with relevant peers and help you set up meaningful 1-on-1 meetings inadvance. Many of our best conversations start with: “I came in knowing no one — and left with three partners.

Not at all. You’ll skip common mistakes, learn from those who’ve already scaled, and gain a clearstarting point tailored to real CEE conditions.

.png)